The Case for Buying a Condo

If you’re looking for a cheaper, low-maintenance home ownership experience, condos and townhouses provide a unique opportunity to earn equity but still live like a renter.

If you want to own a home but are worried about filling up your weekends with house projects, buying a condo or a townhouse might be the perfect option for you! In addition to being less work to maintain, condos and townhouses are especially attractive during this period of higher interest rates given their affordability.

The pros of condo/townhouse ownership

There are many reasons a condo or townhouse may be more attractive to you than owning a single-family residence. Let’s look at why buying a condo or a townhouse in Portland may be the right move for you.

Price Tag – By far, the most attractive aspect of buying a condo in Portland is the price tag. Finding an affordable single-family home in Portland that doesn’t have a number of condition issues can be a headache. Depending on what you are looking for, you can still find a great condo in the $200-350k range.

Location, Location, Location – There are lots of condos available in prime urban locations around Portland. If you are on a budget but hoping to live in an ultra-walkable neighborhood with all the fun shops and restaurants, a condo may be your best bet.

Maintenance – If you don’t want to spend your free time mowing the lawn, pulling weeds, and pressure washing, condo and townhouse ownership provides a less maintenance intensive experience. Spend more time hanging art and picking the right paint color and less time sweating in the yard.

Community – Condos and townhouses are great options for people who are craving more of a sense of community. Living in a large building or complex offers lots of opportunity to meet and socialize with your neighbors and being a member of the HOA gives everyone a collective sense of working toward the common good.

Amenities – Want a pool or a hot tub without having to maintain it? Wish you could walk down the hall to your gym? Larger buildings and complexes often have amenities like recreational areas, meeting spaces, and storage that you wouldn’t be affordable in a single-family home.

What is a condo anyways?

Condos (or condominiums) refer to a type of home ownership where the homeowner owns a unit within a larger building or complex and share ownership of the land and any common elements of a property. There are a number of different types of condos in Portland, Oregon. From turn-of-the-century multi-story buildings loaded with vintage charm to newly constructed cottage clusters, there are a ton of great options to take the first step toward home ownership. Let’s take a look at the different types of condos available:

Condo Building – This is the most common type of condo in Portland. This type of condo refers to a larger building or complex of buildings that includes several condos within. In Portland, you’ll find these buildings in more centrally located areas of town. Larger buildings, especially those that are newer construction, typically have more amenities like fun common areas, storage, and recreational facilities.

Converted Condos – The second most common type of condo in Portland is larger single-family homes or multi-family homes like duplexes and triplexes that have been converted to condos. This type of condo offers an ownership experience that is a little closer to living in a single-family home in terms of having slightly more privacy and is more likely to include some yard space.

Detached Condo – Detached condos are condos where there are no shared walls but the land is still jointly owned. With no shared walls, this type of condo offers extra privacy and is the closest form of condo ownership to living in a single-family home.

What is the difference between a condo and a townhouse?

The primary difference between condos and townhouses is that the homeowner owns the land directly beneath their townhouse. Townhouses are attached homes where the homeowner owns the unit itself, the land beneath the unit, and share ownership of the common elements of the building or complex. The land you own usually includes a bit of yard and/or space for parking. Like condos, some townhouse complexes have fun amenities like exercise facilities or pools.

What is an HOA and how does it work?

All condos and most townhouses have an HOA, or homeowners’ association, in place to manage and govern the common areas and take care of maintenance. The HOA is a private organization formed by a developer when a complex is built or afterward by a community of homeowners. All homeowners are usually required to be members of the HOA and the HOA is governed by a board of directors who are chosen by a community vote.

The HOA’s core responsibilities include producing guidelines for the maintenance and management of the common spaces, defining what alterations are acceptable to a unit, and enforcing rule violations. The HOA collects a monthly fee that goes toward both short term maintenance needs like landscaping and longer-term projects like replacing siding or roofs. The monthly fee residents are assessed is determined based on the community’s needs and is voted upon by the community.

Maintenance: Who’s responsible for what?

While every condo and townhouse have different maintenance responsibilities based on their HOA agreement, here is what is typical in terms of what you can expect in terms of maintenance. When you own a condo in a larger building or complex, you are typically responsible for maintaining the unit from “drywall to drywall”. In other words, you’re responsible for all the house systems, floors, and drywall inside your unit. The plumbing, electrical, and structural components that are in the walls or outside of your unit are typically the HOA’s responsibility. For townhouses, your maintenance responsibilities can extend to electrical, plumbing and HVAC systems that are in walls and underground. Your responsibility for those systems usually ends at the border of your property and the common space. Exterior elements like roofs and siding are typically the HOA’s responsibility, although a homeowner may be responsible for windows and doors.

The cons of owning a condo or townhouse

We’ve looked at all the reasons owning a condo/townhouse in Portland is a fantastic option. But, like all forms of home ownership, there are downsides to consider.

Shared walls – With the exception of detached condos, both condos and townhouses have at least one shared wall. To many this isn’t a big deal, and most buildings are constructed to limit sound transfer between units. But for those with barky dogs, loud kiddos, or musical instruments, sharing a wall can feel like a deal breaker.

Appreciation – As a general rule, attached housing tends to appreciate at a lower rate than detached housing. Condo/townhouse ownership is still a good long-term investment, but you won’t necessarily see the same returns as you would with a single-family home.

HOA Fees – This isn’t necessarily a con, but it may feel like one to some. Depending on what the HOA fee covers and the availability of amenities, your monthly HOA fee can be quite steep. As you are shopping for a condo or townhouse, make sure you are aware of what your monthly HOA fee will cost and what it covers. As you are evaluating the HOA fee, it’s important to remember that a portion of your fees are being set aside to fund surprise repairs and big-ticket items like roofs.

In Conclusion

For some, buying a condo or a townhouse is a no brainer! Whether you want to be in the heart of the city with fewer maintenance responsibilities or you are finding that affordability is a challenge, buying a condo or townhouse is a great alternative to renting. Especially in down markets, buying a condo can be a golden opportunity for buyers who are looking for a deal. So, if you’ve read this far and you’re tired of renting, consider this your sign to reach out. We’ll talk about your housing goals and come up with a personalized approach to buying a home.

How to Mitigate the Effect of Rising Interest Rates on Home Buyers

Interest rates have had a big impact on housing affordability. HOWEVER, there are plenty of strategies to mitigate the impact of rates on your journey to homeownership.

If you’re thinking about buying or selling a home, you’ve likely been keenly aware of rising interest rates. With inflation soaring to the highest level since the 1980s, ‘the Fed” launched it’s attack on inflation by raising interest rates consistently since the Spring. But what does it really mean when the Fed raises rates and how will that affect the housing market? Let’s take a look!

Who is the Fed Anyways?

The Federal Reserve (the Fed) is the government agency in charge of monetary policy by controlling inflation and maintaining healthy unemployment levels. The Fed controls inflation by manipulating two key interest rates: the Federal Funds Rate and the Discount Rate.

The Federal Funds Rate controls the rate at which banks loan their reserves to other banks. All banks are required to maintain a portion of their customers’ deposits at a Federal Reserve bank. When there are excess funds in a bank’s account, they can be loaned out to other banks.

The Discount Rate is the rate at which banks can borrow money from the Fed. When banks need short-term loans to head off any liquidity problems they can turn to the fed for quick help.

What Happens When the Fed Raises Interest Rates?

Essentially, when the Fed lowers rates, it’s stepping on the gas pedal of the economy. Access to money becomes cheaper for consumers, so spending increases and more investments are made in the form of buying stocks and capital.

When the Fed increases rates, it is hitting the brakes on the economy. Money becomes more expensive for consumers, so consumers are incentivized to save and reduce spending.

What does that have to do with mortgage rates? Well, nothing directly.

Where do Mortgage Rates Come From?

In order to talk about what drives mortgage rates up and down, we have to talk about what happens when a mortgage is processed by your bank. When you close on a house, a lender sends money to escrow to be distributed. But, banks don’t have endless capital. To enable banks to make more loans available, the government created Fannie Mae (and later Freddy Mac) to buy those mortgages and replenish the cash on hand for local banks. Fannie Mae then bundles those mortgages and sells bonds (mortgage-backed securities) to investors.

The demand for those bonds is really what drives mortgage rates up or down. When the demand for bonds is weak, interest rates rise because Fannie Mae has less incentive to buy mortgages from the banks, meaning banks have less incentive to sell mortgages to consumers. When the demand for bonds is high, interest rates decrease because Fannie May can make more money from buying mortgages from banks, giving banks more incentive to sell mortgages to consumers.

Why Are Mortgage Rates Going Up?

Now that we understand that mortgage rates are closely tied to the demand for bonds, let’s look at what is happening in the bond market that is forcing rates to creep up. Right now, there are two main reasons for decreasing bond demand. First, in response to the COVID-19 pandemic, the government implemented a bond buying program to stimulate the economy. The Fed will be decreasing the amount of bonds it buys throughout the year, meaning a sharp decline in demand for bonds. Second, rising inflation means that a bond will have less purchasing power over time, making it less desirable to own.

How Do Rising Mortgage Rates Affect Homebuyers?

To put it simply, if rates go up 1%, your buying power will decrease by roughly 10%.

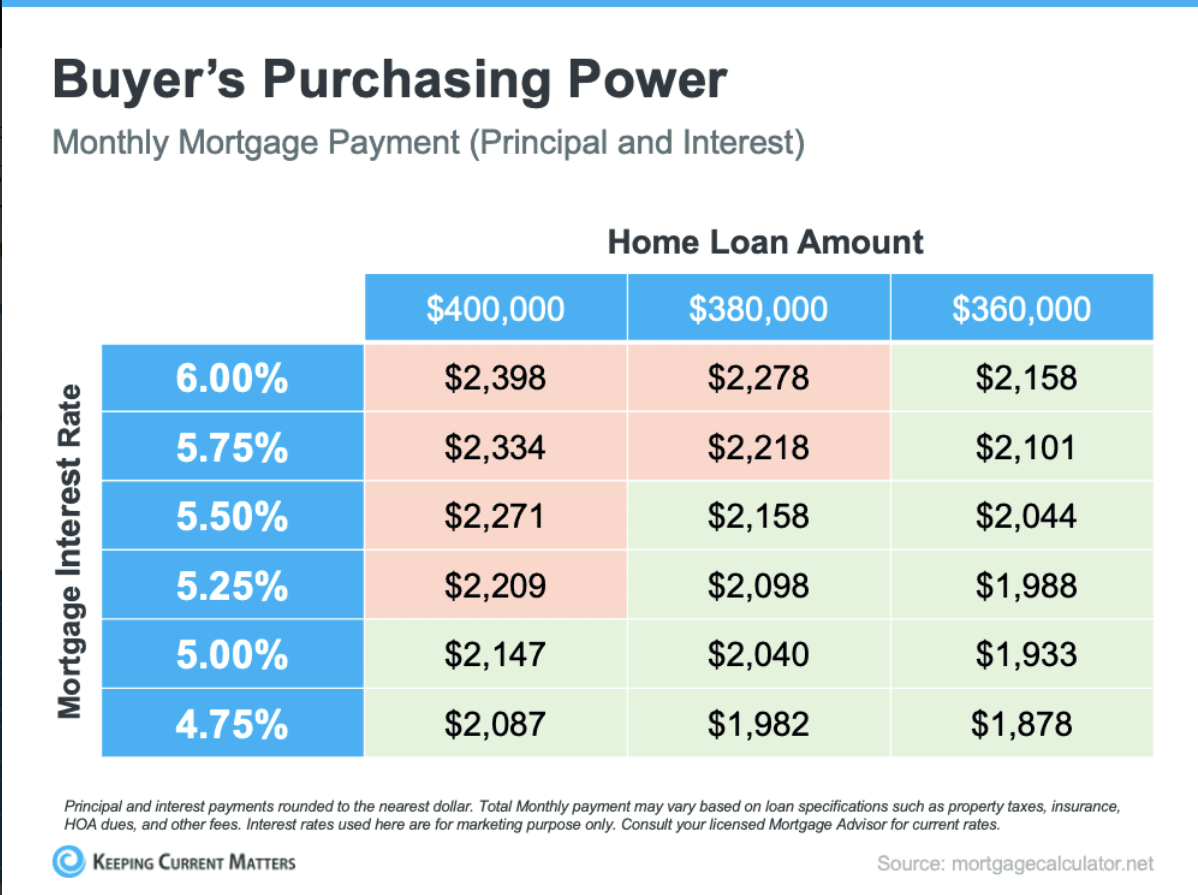

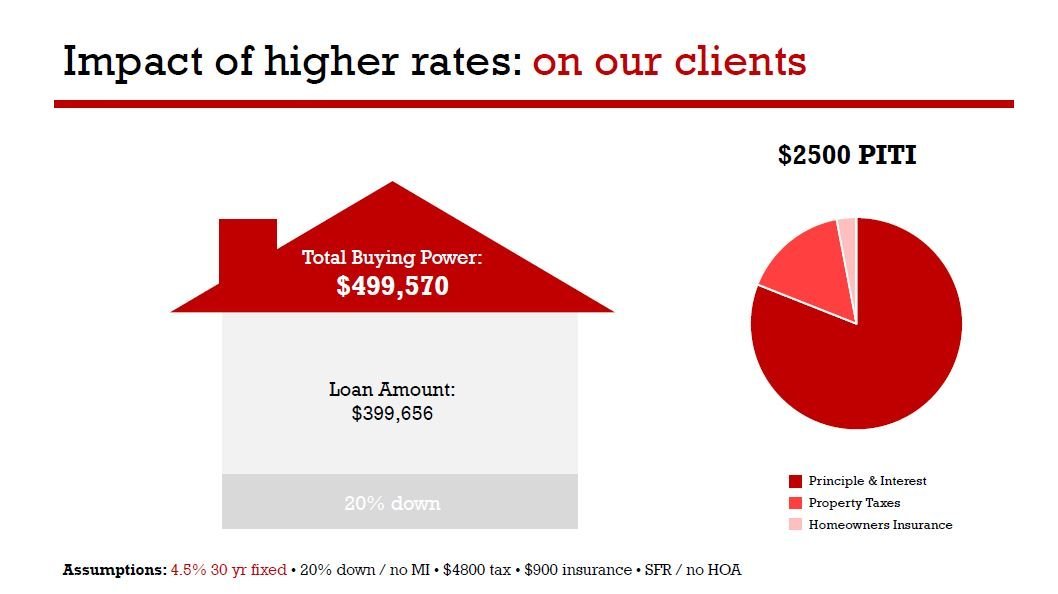

So, if we look at these two slides closely, we can see that with a $2500 dollar payment with a 3.5% fixed-rate mortgage you can buy a $563,976 house. But, when that mortgage rate increases to 4.5%, your maximum purchase value drops to $499,570. (Images courtesy of Julee Felsman, Rate.com)

How Can You Mitigate the Effect of Rising Interest Rates?

Buy When It’s Right for You: It’s safe to assume that interest rates are going to continue to climb at least through the end of the year, and we don’t know when or if we’ll see them return to the all-time lows we’ve seen over the past few years. So if it’s the right time for you to buy, don’t let interest rates spoil the fun. If you buy at a higher rate, you can always refinance when rates dip again.

Talk to Your Banker About Mortgage Options: There are several loan options including adjustable-rate mortgages and jumbo loans that may allow you to save money on your monthly expenses or your total cost of ownership.

Buydown Your Rate: You can buy down your interest rate (also known as buying points) to lower your monthly payment either using your own cash or by negotiating credits from a seller. You can either buydown the rate temporarily to allow time to ease into your mortgage payments, or buy the rate down permanently.

Don’t Panic

While rising interest rates may seem scary, we have seen some relief in the form of falling home prices. If interest rates were up and housing prices continue to rise or stay the same, buyers would have been faced with big increases to the their monthly expenses.

If you look closely at the purchasing power chart below, one important thing to call out is that your monthly payment on a $400,000 house with a 4.75% rate is only $71 cheaper than the monthly payment on a $360,000 house with a 6% rate.

The bottom line is that you should buy or sell when it’s right for you and not let interest rates spoil the fun! Feel free to reach out. I’d be happy to help you evaluate all the pros and cons of buying and selling in this market.

Hopefully this short economics lesson provides you with a bit of clarity in terms of what is happening in the housing market right now, and maybe even gives you some encouragement to pursue your dreams of home ownership.