How to Mitigate the Effect of Rising Interest Rates on Home Buyers

If you’re thinking about buying or selling a home, you’ve likely been keenly aware of rising interest rates. With inflation soaring to the highest level since the 1980s, ‘the Fed” launched it’s attack on inflation by raising interest rates consistently since the Spring. But what does it really mean when the Fed raises rates and how will that affect the housing market? Let’s take a look!

Who is the Fed Anyways?

The Federal Reserve (the Fed) is the government agency in charge of monetary policy by controlling inflation and maintaining healthy unemployment levels. The Fed controls inflation by manipulating two key interest rates: the Federal Funds Rate and the Discount Rate.

The Federal Funds Rate controls the rate at which banks loan their reserves to other banks. All banks are required to maintain a portion of their customers’ deposits at a Federal Reserve bank. When there are excess funds in a bank’s account, they can be loaned out to other banks.

The Discount Rate is the rate at which banks can borrow money from the Fed. When banks need short-term loans to head off any liquidity problems they can turn to the fed for quick help.

What Happens When the Fed Raises Interest Rates?

Essentially, when the Fed lowers rates, it’s stepping on the gas pedal of the economy. Access to money becomes cheaper for consumers, so spending increases and more investments are made in the form of buying stocks and capital.

When the Fed increases rates, it is hitting the brakes on the economy. Money becomes more expensive for consumers, so consumers are incentivized to save and reduce spending.

What does that have to do with mortgage rates? Well, nothing directly.

Where do Mortgage Rates Come From?

In order to talk about what drives mortgage rates up and down, we have to talk about what happens when a mortgage is processed by your bank. When you close on a house, a lender sends money to escrow to be distributed. But, banks don’t have endless capital. To enable banks to make more loans available, the government created Fannie Mae (and later Freddy Mac) to buy those mortgages and replenish the cash on hand for local banks. Fannie Mae then bundles those mortgages and sells bonds (mortgage-backed securities) to investors.

The demand for those bonds is really what drives mortgage rates up or down. When the demand for bonds is weak, interest rates rise because Fannie Mae has less incentive to buy mortgages from the banks, meaning banks have less incentive to sell mortgages to consumers. When the demand for bonds is high, interest rates decrease because Fannie May can make more money from buying mortgages from banks, giving banks more incentive to sell mortgages to consumers.

Why Are Mortgage Rates Going Up?

Now that we understand that mortgage rates are closely tied to the demand for bonds, let’s look at what is happening in the bond market that is forcing rates to creep up. Right now, there are two main reasons for decreasing bond demand. First, in response to the COVID-19 pandemic, the government implemented a bond buying program to stimulate the economy. The Fed will be decreasing the amount of bonds it buys throughout the year, meaning a sharp decline in demand for bonds. Second, rising inflation means that a bond will have less purchasing power over time, making it less desirable to own.

How Do Rising Mortgage Rates Affect Homebuyers?

To put it simply, if rates go up 1%, your buying power will decrease by roughly 10%.

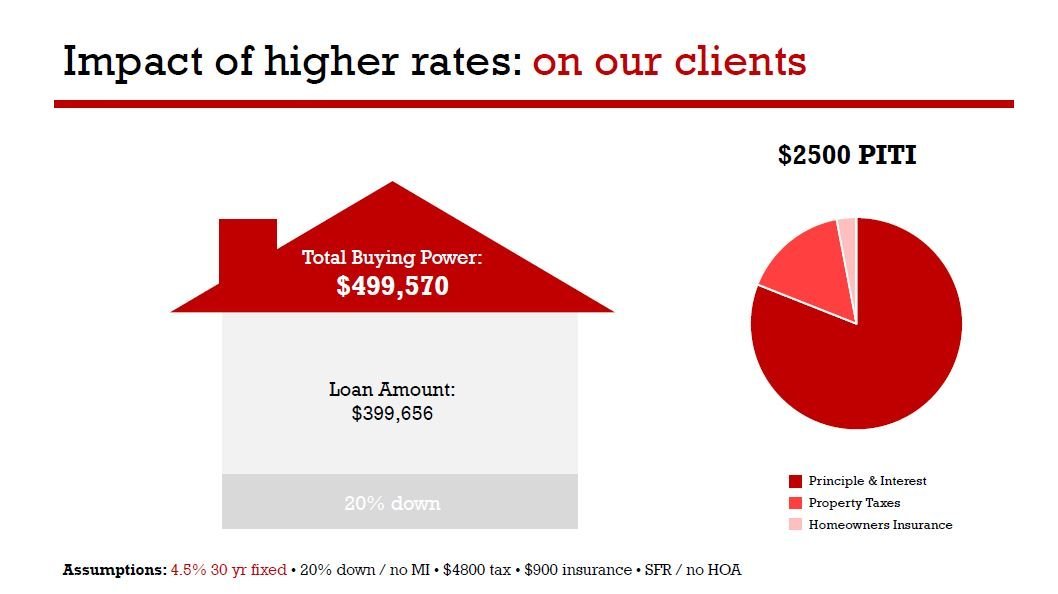

So, if we look at these two slides closely, we can see that with a $2500 dollar payment with a 3.5% fixed-rate mortgage you can buy a $563,976 house. But, when that mortgage rate increases to 4.5%, your maximum purchase value drops to $499,570. (Images courtesy of Julee Felsman, Rate.com)

How Can You Mitigate the Effect of Rising Interest Rates?

Buy When It’s Right for You: It’s safe to assume that interest rates are going to continue to climb at least through the end of the year, and we don’t know when or if we’ll see them return to the all-time lows we’ve seen over the past few years. So if it’s the right time for you to buy, don’t let interest rates spoil the fun. If you buy at a higher rate, you can always refinance when rates dip again.

Talk to Your Banker About Mortgage Options: There are several loan options including adjustable-rate mortgages and jumbo loans that may allow you to save money on your monthly expenses or your total cost of ownership.

Buydown Your Rate: You can buy down your interest rate (also known as buying points) to lower your monthly payment either using your own cash or by negotiating credits from a seller. You can either buydown the rate temporarily to allow time to ease into your mortgage payments, or buy the rate down permanently.

Don’t Panic

While rising interest rates may seem scary, we have seen some relief in the form of falling home prices. If interest rates were up and housing prices continue to rise or stay the same, buyers would have been faced with big increases to the their monthly expenses.

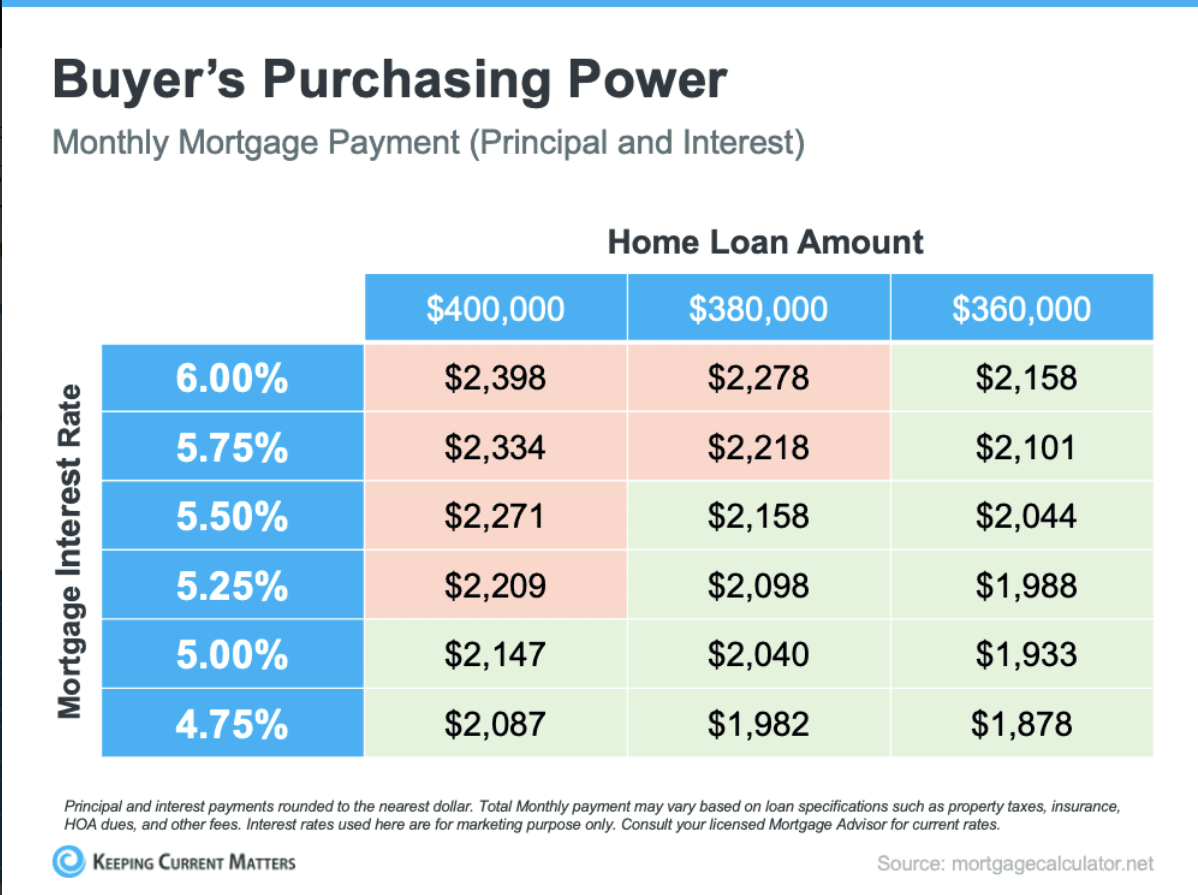

If you look closely at the purchasing power chart below, one important thing to call out is that your monthly payment on a $400,000 house with a 4.75% rate is only $71 cheaper than the monthly payment on a $360,000 house with a 6% rate.

The bottom line is that you should buy or sell when it’s right for you and not let interest rates spoil the fun! Feel free to reach out. I’d be happy to help you evaluate all the pros and cons of buying and selling in this market.

Hopefully this short economics lesson provides you with a bit of clarity in terms of what is happening in the housing market right now, and maybe even gives you some encouragement to pursue your dreams of home ownership.